Our Expertise

An End-to-End Digital Workflow covering all life-stages of Green, Social & Sustainable Bonds

Simplifying and Bringing Transparency in the Debt Capital Market

We provide seamless workflows, easy interactive dashboards paired with advanced analytical features to streamline and optimize planning, issuance and management of Green, Social and Sustainability (GSS) bonds throughout its lifecycle.

Automated

Standardized

Optimized

Origination

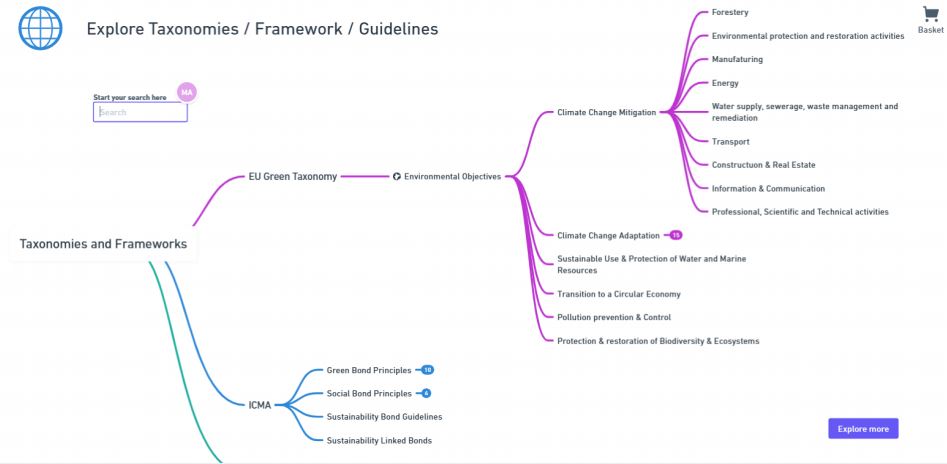

Digitized Frameworks & Taxonomies

✓ Intuitive & Interactive

✓ 1000+ Pages and Data Points captured

✓ Advance Search

✓ Benchmarks selection

✓ Compare multiple frameworks

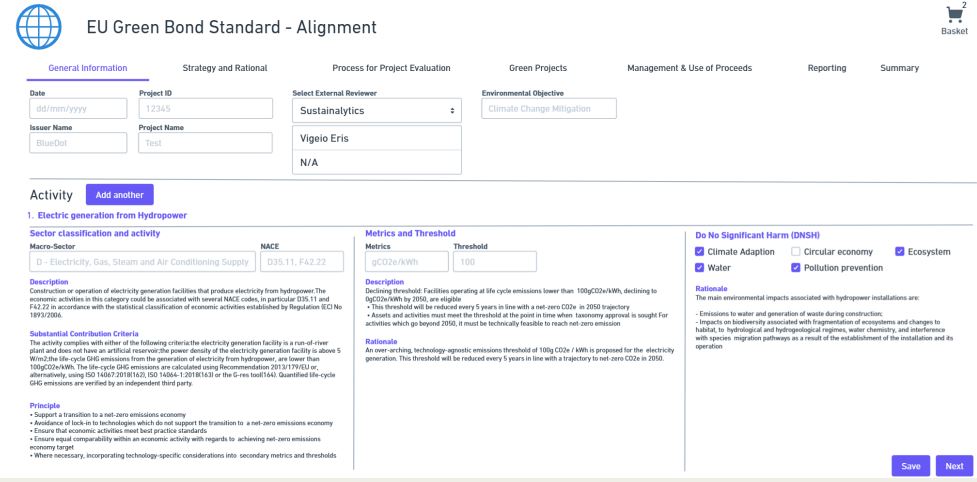

Issuance

Digitized Workflows

✓ Standardized & Structured

✓ Optimized

✓ Audit Trail

✓ Enhanced governance

✓ Data driven articulation of Sustainability credentials

✓ KPIs Calibration

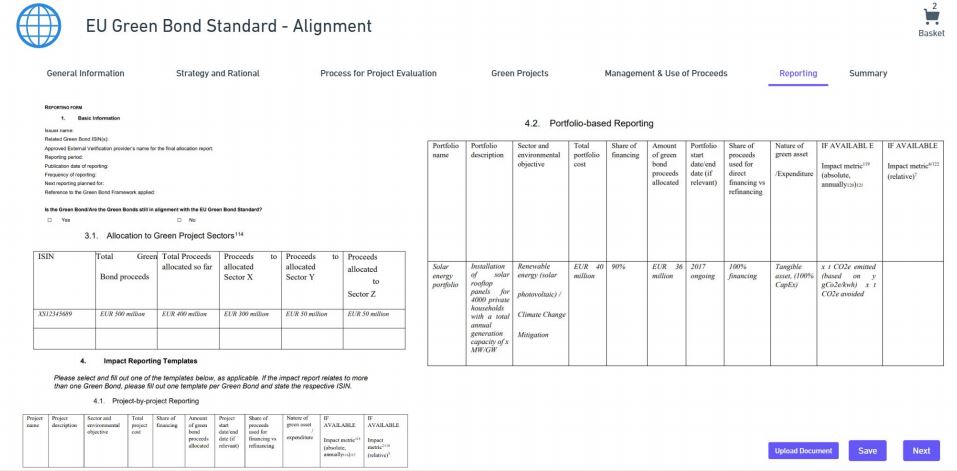

Servicing

Reporting & Disclosures

✓ Automated & Optimized

✓ Audit Trail

✓ Robust Risk Compliance

✓ Data granularity

FAQ

What is BlueDot

At BlueDot we develop task management software, focused on the needs of Sustainability teams and professionals in Debt Capital Markets, by providing seamless workflows, easy interactive dashboards paired with advanced analytical features to streamline and optimize planning, issuance and management of Green, Social and Sustainability bonds throughout its lifecycle.

What is BlueDot Services

BlueDot, is developing a SAAS B2B digital platform, which aims to

-> Task Management Solution: Lower additional costs of GSS+ Bond issuance and introduce operational efficiencies for Issuers and Arranging Banks.

-> Standardized Reporting Solution: Provide data granularity in ESG reporting to Investors.

What is BlueDot's Value Proposition?

At BlueDot we are developing task management software addressing ‘Green’ Bond value chain, focused on the needs of Sustainability teams and professionals in Debt Capital Markets.

Persona specific workflows, easy interactive dashboards paired with advanced analytical features to streamline and optimize planning, issuance and management of Green, Social and Sustainability bonds throughout its lifecycle. Thereby, lowering cost and adding efficiencies for our Clients.

How will Clients benefits from BlueDot?

BlueDot provides its clients with opportunities to eliminate operational efficiencies and automate critical processes, leading to significant cost savings. This approach will also establish a robust framework for traceability and transparency, which are essential in this rapidly expanding market segment.

What is EU Taxonmy?

The EU Taxonomy framework provides a classification system for environmentally sustainable economic activities, guiding the issuance and investment in ESG bonds. It sets criteria for determining sustainability, ensuring that investments genuinely contribute to environmental objectives. This framework enhances transparency and supports the EU’s broader climate and sustainability goals.

What is ICMA Framework?

The ICMA framework for ESG bonds establishes guidelines for issuing Green, Social, and Sustainability Bonds. It emphasizes transparency, accountability, and reporting standards to ensure funds are used for genuine environmental or social benefits. This framework helps investors assess the impact of their investments and promotes trust in the market.

What are ESG Bonds and its types?

ESG bonds are fixed-income securities that fund projects with positive environmental, social, or governance impacts. Key types include:

- Green Bonds: Fund environmental projects like renewable energy.

- Social Bonds: Support social initiatives, such as affordable housing.

- Sustainability Bonds: Combine green and social projects.

- Sustainability-Linked Bonds: Tied to the issuer’s ESG performance targets.

These bonds promote sustainable practices while providing investors with financial returns.

How AI will help in end-to-end workflow?

AI will optimize essential tasks in ESG issuance and reporting workflow by automatically collecting data upon document upload, removing the need for manual input. An intelligent advisor responds to legal and ESG inquiries, reducing the reliance on expensive consultations. This streamlined approach frees up time to focus on sustainability initiatives, while industry benchmark analysis provides tailored recommendations, accelerating your organization’s green transition.

A Bond is a Bond..... Unless its GREEN

Digitizing the global sustainability frameworks to accelerate capital flow into debt markets for a greener economy